What are the New Highway Code changes for 2022?

We spoke to Bernard Thornton, Fellow and Chartered Insurance Practitioner at the Chartered Insurance Institute, about the new changes to the Highway Code and what this means from an insurance point of view for employers.

Although they may have flown in under the radar, some very important changes were made in January to the Highway Code, known in some quarters as the ‘Road Users Bible’. Some drivers will be blissfully unaware that anything has changed, whilst many others will have a vague awareness that something has happened without understanding the detail. In fact, not only do the updates comprise essential information for virtually everyone, but there are also direct implications for anyone paying Motor insurance premiums.

What are the changes?

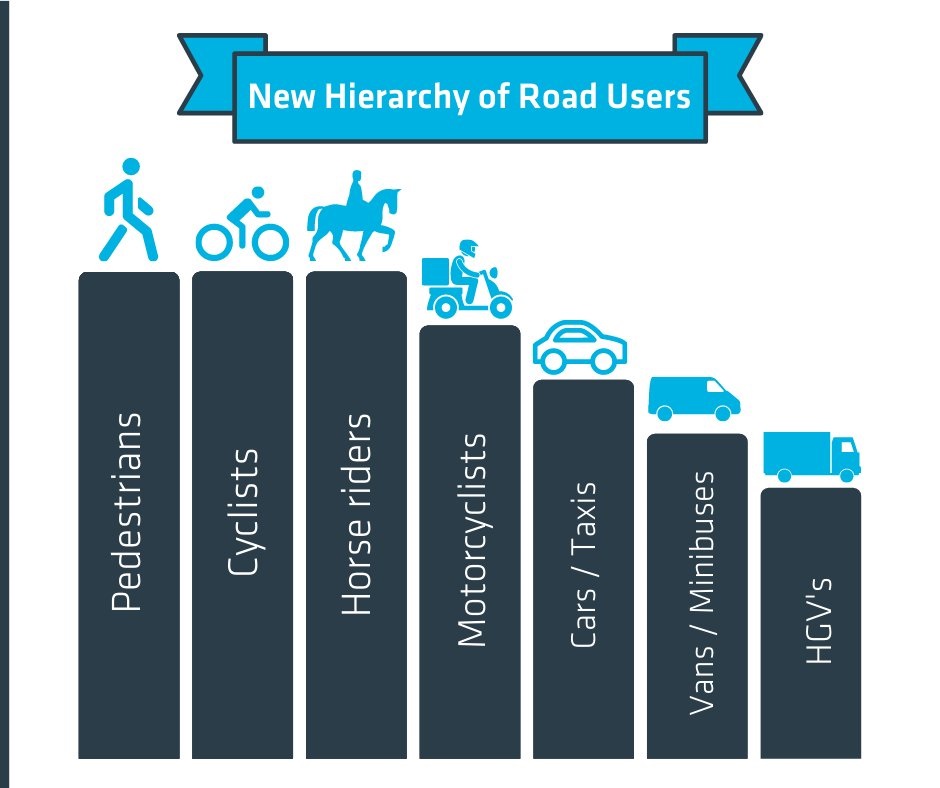

1. The most significant amendment is that a ‘hierarchy’ of road users has been established. This is neatly summed up by the Department of Transport thus:

‘Those who can do the greatest harm to others have a higher level of responsibility to reduce the danger’.

Quite simply, the higher the column, the higher the priority for that particular group of road user.

Ever since roads were first built, the guiding principle has been that if two parties were equally liability for an accident, liability was deemed to be split 50/50, irrespective of the mode of transport.

Not so now. In the case of disputed liability, there is every likelihood that the party at the lower end of this pecking order would be found to have the greater, if not all of the liability share.

2. Drivers must give way to pedestrians at junctions. It is a driver’s responsibility to look out for pedestrians (and other higher priority road users) even if they are still on the pavement at the time. So, for instance, if a pedestrian is intending to cross a side road which a motorist is turning into, the onus is on the driver to be aware of the likelihood of the pedestrian stepping into the road and act accordingly.

3. Similarly, motorists must give way at pedestrian crossings. Previously this was only a requirement once a pedestrian had stepped onto the crossing.

4. Cyclists are entitled (even encouraged) to ride two abreast and to ride in the centre of a lane in urban areas. In other words, they should position themselves where they are most visible and feel safest. Drivers must allow a space of at least 1.5m when overtaking cyclists.

5. Furthermore, motorists are expected to be aware of cyclists approaching from behind, even from some distance away. So, in this case the previously universal rule of not overtaking on the inside may not necessarily apply.

6. The use of hand-held mobile phones is banned, other than in an emergency. If this seems like a repeat of the current position, it does in fact close a loophole in the previous outdated law, which banned the use of phones only for calls and texts. Sensibly, this now extends to the use of a phone for any purpose other than emergency calls.

7. Extension of penalty fines for minor offences. This relates to such misdemeanours as illegal U-turns, not giving way and blocking a box junction. Fixed penalties can now be given by local authorities as well as the police.

8. ‘Dutch Reach’. By opening a car door with the hand furthest away, the body naturally turns side-on. This prompts the driver or passenger to check behind for cyclists etc before opening the door.

How will this affect insurance claims?

It should be noted that all road users are still required to have regard to the safety of themselves and others. The Highway Code is for guidance, not statute. However, the practical effect will be that drivers of the potentially more dangerous vehicles will bear the onus of disproving any allegations of liability.

The terms of the new Code mean that there will inevitably be cases where insurers of larger vehicles have to deal with claims which would otherwise be unproven or settled by split liability. From an insurance point of view, it is hard to see any positives in this for drivers or owners of motor vehicles, particularly larger goods carrying ones. Except of course, when said drivers and owners are using the roads in their capacity as pedestrians or cyclists, in which case they might just find the roads a little safer, which after all is the whole purpose of the exercise.

All drivers should be aware of the full extent of the new Code, which can be referenced here.

Employers are also encouraged to ensure that anyone driving on their business is provided with a copy of the changes.

To learn more about motor fleet insurance management, get in touch with our specialist Russell Scanlan motor insurance team today on 0115 798 0786 or email contactus@russellscanlan.com.